We Will Get You The Plan You Need

Have you been looking into Medicare Part D plans and feeling puzzled about things such as deductibles, initial coverage, copays, and the coverage gap? If so, you are in luck! Below, I will review how Medicare Part D works as well as the four stages within Part D plans. Hi there! If we haven’t met yet I’m Justin Eggenberger, founder of Apex Planning Group, where we provide free Part D evaluations every year for all of our clients who request a review.

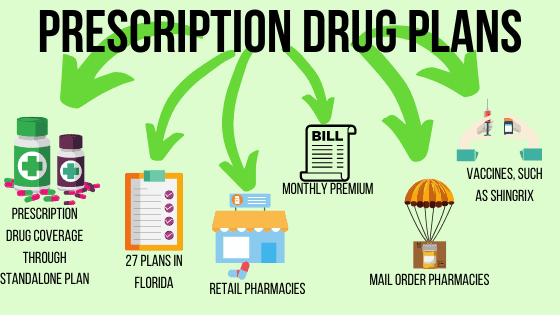

Part D drug plans are offered by private insurance companies and each plan must fulfill government standards. Stand-alone prescription plans have four cost-sharing phases. Insurance companies may offer coverages that are richer than the minimal standard but not less than that standard. The four stages of Part D are: deductible, initial coverage, coverage gap or “donut hole,” and catastrophic coverage.

A deductible is the amount you pay out-of-pocket each year for medications prior to the time cost-sharing begins under your plan. Medicare sets the maximum deductible each year. Part D insurance companies must maintain their plan deductibles at or below that amount. In 2021, the maximum deductible for stand-alone prescription drug plans is $445. However, companies may forgo that insurance deductible or establish a lower deductible. Here is how the insurance deductible works. If your plan has a $445 deductible, you may pay out of your own pocket for your medicine until you have invested that amount and satisfy the entire deductible. For instance, if you have a drug that costs $100 at the pharmacy, you pay $100 and afterwards you will have $315 to spend before you have satisfied the deductible. Some insurers may offer a lower insurance deductible than Medicare’s set deductible, or they might forgo the insurance deductible all together. A plan with no insurance deductible is not always the one that is most cost-effective. Occasionally, you might find a plan that waives the deductible yet the plan has higher co-pays or premiums than other plans with a deductibles. As a side note, some companies cover the first (or second) tier of medications without applying a deductible to the costs.

The second stage of a Part D drug plan is initial coverage. During this stage, you might pay a co-pay or co-insurance for each medication based upon into which tier the medicine falls. Insurance companies maintain a list of covered medications (a formulary) for each plan, and these drugs are generally broken down into five tiers: preferred generic, non-preferred generic, recommended brand name, non-preferred brand, and specialized medicine. Each rate will have a co-pay or co-insurance related to it. Generally, preferred generics will have the lowest co-pays and specialty medications will have the highest. As an example, you might see a medication plan includes a $5 co-pay for favored generics, $10 for non-preferred generics, $40 for favored brand drugs, and so on. The co-pay amount noted for that tier is what you will pay for your medications. As you fill your medication prescriptions, Medicare tracks your overall drug expenditures (what you pay and what the insurance company discounts or contributes).

If drug expenditures exceed a specific limit annually ($4,130 in 2021), you fall into stage three, the coverage gap, sometimes known as the “donut hole.” When you are in the coverage gap, you pay 25% of the plan’s cost for covered brand name drugs and 25% of the plan’s cost for covered generic drugs until your out-of-pocket costs total $6,550 (in 2021). A vast number of clients do not reach the coverage gap, but it does happen. Why would our government place a large coverage gap right in the middle of these plans? The coverage gap was built into Part D plans to encourage people to use common medicines whenever possible. This keeps the expense down for the nationwide Part D program as a whole.

Lastly, stage four is catastrophic coverage. Once you get to stage four, your Part D responsibilities will be whichever is greater: 5% of the cost or $3.70 co-pay for generic (and brand name treated as generic) medications and $9.20 co-pay for all other drugs. Again, dollar amounts are based on 2021 information released in early October.

If this seems complicated and you question how to choose a strategy, I have some tips for you. Medicare’s website has a plan finder that allows you to enter your medications. It will tell you which drug plans will cover the drugs that you need at one of the most economical rates. It’s a superb tool to assist with comparing prices. If you happen to have your MediGap policy with Apex Planning, you may request our free assistance with part D. Apex Planning will run the plan finder evaluation for you and help you choose a plan that makes the most sense.

27.3%

Average

Aged 65-79 years utilize 27 prescriptions per year.

1%

Enrollment penalty

For each month you delay enrollment in Medicare Part D. Unless you: Have creditable drug coverage

7%

Increase

Estimated average monthly PDP premium for 2020 from 2019

Some Major Brands We Work With

Let’s Make Things Happen

Talk with Justin to know all the ins and outs when it comes to prescription-drug-plans

“Justin explained in great detail just what I needed for my situation.”